Activist investors have a message for retailers and restaurant chains: Spin off your property into a real estate investment trust, or we’ll take over your board and force you to. Activists say that spinning off or selling properties can boost a company’s stock price and reward investors who would otherwise miss a chance to benefit from record real estate values. Creating a REIT can also provide cash for companies looking to make an acquisition or other strategic move. Under pressure from hedge funds, Darden Restaurants has agreed to spin off property into a REIT, then lease the buildings back.

Read MoreAres, Redevco launch €500m Iberian retail JV

Los Angeles-based Ares Management and pan-European real estate investment management company Redevco have launched a €500 million joint venture to invest in value-add and opportunistic Iberian retail.

The joint venture has been formed to invest in shopping centers, retail parks and high street properties in Spain and Portugal. It will be seeded with a combination of assets in the Iberian peninsula from funds managed by Redevco and Ares that have a combined value of approximately €110 million.

Retail specialist Redevco will be the local manager of the joint venture’s assets.

Low interest rates and rental growth supports positive outlook for Europe’s listed property sector (EU)

Investors in European listed property companies will benefit from about two years of low interest rates, rental growth and rising asset values, J.P. Morgan Chase & Co. analyst Tim Leckie told the European Public Real Estate Association’s (EPRA) annual conference on Wednesday.

Read MoreSpain house prices rise at fastest rate since property crash

House prices in Spain rose at their fastest annual rate for eight years in the second quarter, according to official data.

The country’s National Statistics Institute says prices increased by four percent year-on-year from April to June – that’s the best since the end of 2007.

Prices for new house prices were up by 4.9 percent compared to the same period last year; second hand prices rose by 3.8 percent.

Read MoreSpanish Home Prices Jump Most Since Crisis Bolstering Recovery

Spanish house prices jumped the most on record in the second-quarter, strengthening the foundations of the country’s economic recovery.

Housing rose 4.2 percent in the quarter compared with a 0.6 percent contraction in the previous three months, according to data released by Spain’s National Statistics Institute on Tuesday. That was the fastest clip since the institute, known as INE, started publishing real estate prices in 2007.

Read MoreLone Star Seeks $1.1 Billion to Enlarge Portuguese Golf Resort

Lone Star Funds is seeking partners to invest 1 billion euros ($1.1 billion) in Vilamoura, a residential golf resort in Portugal’s Algarve region that’s more than eight times the size of Monaco.

The U.S. private-equity firm is teaming up with Vilamoura World to double the number of homes at the resort to about 10,000 within five years, according to Paul Taylor, chief executive officer of the Portuguese developer. They also plan to build as many as five hotels with about 4,000 rooms on the site, which already has five 18-hole golf courses and an 825-berth marina.

Read MoreReal estate attractive despite pricing concerns

A diverse range of institutional investors choose to invest in the real estate asset class, each with their own set of objectives. The diversification benefits of real estate were cited by the largest proportion of respondents, most likely due to the asset class’s relatively low correlation to traditional asset classes and the diversity of property types, strategies and locations available on the market. Large proportions of surveyed investors also choose to invest in real estate because of its inflation hedging properties and the asset class’s ability to generate a predictable and reliable income stream.

Read MoreFree Lunch: Sketches of Spain

Spain has been gaining attention as it keeps notching up some of the fastest growth in the eurozone, to the point of usurping Ireland’s status as “star pupil” of the monetary union’s official policy prescriptions. With national elections looming, the Spanish government is keen to insist that the austerity-with-reforms orthodoxy it implemented is bearing fruit.

Read MoreSpain Property Renaissance Gives Life to Stock Turnaround

Sergio Berdion lived his whole life in Madrid until 2012, when Spain’s real estate collapse drove him to Chile in search of work. Last year he came back.

“Things are definitely better,” said Berdion, 36, who works as an intermediary between architects and building contractors. “I don’t know if we’ll ever get back to the boom days, but there’s more and more work.”

Read MoreThe European Funds Industry Faced Estimated Net Outflows of €11.1 bn From Long-Term Mutual Funds for June

The European funds industry faced estimated net outflows of €11.1 bn from long-term mutual funds for June. That said, mixed- asset funds enjoyed opposite flows with estimated net inflows of €12.1 bn during the month, followed by real estate products with €0.2 bn and commodity funds with €0.03 bn. However, bond funds faced estimated net outflows of €17.5 bn, bettered by equity funds (- €2.5 bn), alternative/hedge products (-€2.1 bn), and ”other” funds (-€1.3 bn). These flows added up to estimated net outflows of €11.1 bn from long-term investment funds for June.

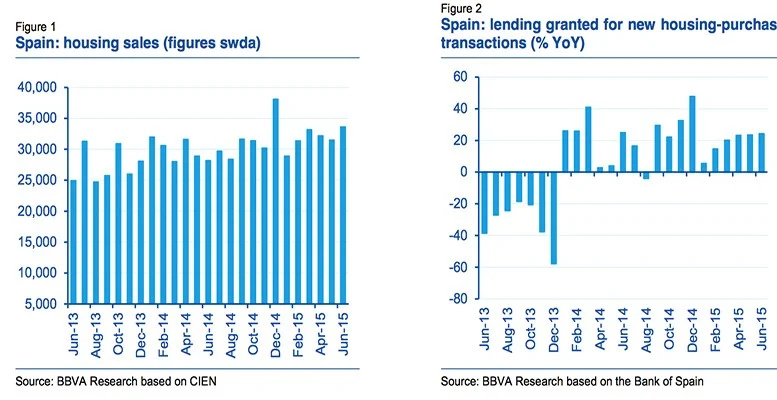

Read MoreEncouraging Prospects For Real Estate In Spain

This positive performance by real estate sales has been underpinned by the sound progress of demand-side fundamentals: on the one hand, in the past six months the Spanish economy has created almost 300,000 new jobs, according to the latest figures from the LBS (Labour Force Survey), while on the other hand, despite the stagnation witnessed in June and July, confidence and the outlook for the next 12 months on the part of consumers continue to show highs.

Read MoreWeak Euro Attracts Rich Asians Seeking Bargains in Property, Luxury Hotels

Stephen Diggle, whose Singapore-based hedge fund made a profit of $2.7 billion in the depths of the global financial crisis, is visiting the small German town of Flensburg this week in a bet the euro’s 12-month slide is almost over.

The euro’s decline against every major Asian currency this year has unearthed real-estate bargains for investors from China to Malaysia and Thailand to Singapore. Diggle’s fund has already bought more than 1,200 apartments in Germany, including many in this town of about 90,000 people, four miles from the Danish border. He’s planning to buy more soon.

Read MoreProperty comprises one-third of alternative assets

Property is the biggest alternative asset class for institutional investors again, making up just over a third of the assets managed by the top 100 managers.

It is popular across investor types, forming the largest allocation for pension funds, insurance companies, sovereign wealth funds, wealth managers and banking assets. Onlyendowments and funds of funds do not have it top of the list, favouring private equity and hedge funds.

Read MoreBouyant demand again for property in Spain

Despite the general nervousness in Europe resulting from the continuing Greek debt crisis and its implications for other peripheral euro zone economies, particularly in southern Europe, transaction activity has picked up substantially in Spain. Both the principal office markets in Madrid and Barcelona and the retail sector across the wider country have seen recent deals that confirm the burgeoning interest of international real estate investors in the Spanish market.

Read MoreThis time will be different

How many times have you heard that before? It’s one of the most often used and abused phrases in real estate, a few simple words that can be used to justify just about any decision, particularly when markets begin to look somewhat frothy.

This time will be different so, of course, it makes complete sense to acquire prime assets in Europe at what can only be described as eye-watering levels. The maths tells us that it makes sense, and the argument verges on the compelling. It begins with a recognition that the prime end of the market is highly liquid, with no shortage of capital in a way that — at any other time — would look remarkably like the peak of the cycle, particularly as we move into a phase of monetary tightening in the United States and the United Kingdom, followed sometime later in the euro zone. But this time will be different because we’re only at the beginning of the economic cycle and rents will surely take over as yield compression runs out of steam.

Read MoreAre we at the start of an asset management cycle?

Over the past couple of years, European real estate returns have been largely driven by investment in distressed opportunities. Value investments were plentiful, both in the core and core-plus styles. Yet, with a more competitive market, such opportunities are now increasingly scarce. Indeed, the next investment cycle is likely to be characterised by lower nominal returns unless investors are willing to “get their hands dirty”. We believe that we are at the start of an asset management–led investment cycle. The kind of expertise required for this type of cycle differs from previous ones. This is a cycle where local knowledge, acquaintance of local occupiers and local business practices and preferences is key.

Read MoreOverseas investors cash in £3.4bn of London property

A wave of mainly Asian investors have been making quick profits from sales of some of London’s largest office buildings, as the commercial property investment boom in Britain’s capital city showed little sign of abating.

Where to Seek Returns When Traditional Investments May Not Be Enough?

Much has been said, and written, recently regarding the end of the “Golden Age” of fixed income. Since the late 1970’s, we have seen a continuous increase in bond prices, coupled with decreasing interest rates across all developed countries. However, since overcoming what was arguably the most catastrophic economic crisis to occur in the last 50 years in the United States, a gradual increase in the cost of money is to be expected. This increase will have a potentially significant impact on nearly every other financial asset and investors will be wise to understand these broad impacts on their own portfolios and investment strategies.

Read MorePortugal’s GDP Expands for a Fifth Quarter on Consumer Spending

Portugal’s gross domestic product expanded for a fifth quarter in the three months through June as household spending increased.

GDP rose 0.4 percent from the first quarter, when it expanded at the same pace, the Lisbon-based National Statistics Institute said on its website today. That matches a preliminary report on Aug. 14. GDP rose 1.5 percent from a year earlier, a seventh increase.

Read MoreCommercial Real Estate Investments in Europe at All-Time-High Since 2007

The first half of the year proved to be a good period for the European commercial real estate industry. Investment volumes rose to its highest levels since 2007, which amounted to €102.5 billion (approximately $115 billion) and marked a 25 percent on same period last year.

Read More