European banks and asset management agencies (AMA) have a gross exposure of EUR531 billion to non-core real estate which is subject to disposal strategies in the upcoming years.

Read MoreSolar and Wind Just Passed Another Big Turning Point

Wind power is now the cheapest electricity to produce in both Germany and the U.K., even without government subsidies, according to a new analysis by Bloomberg New Energy Finance (BNEF). It's the first time that threshold has been crossed by a G7 economy.

Read MoreSpanish property market update - the situation on the ground

According to the headlines, the Spanish property market has bounced back. The latest figures from the Association of Property Registrars show a 5.12% increase in Spanish house prices in the year to June 2015. The jump is the fastest rate of increase since the downturn, with a quarter on quarter rise of 2.8%.

Read MoreBarcelona Catalonia gets boost from recovery in real estate market

The real estate market in the office, industrial and logistics segments has definitely revived in Barcelona and Catalonia. This makes it particularly significant that Barcelona Catalonia, an initiative promoted by the Government of Catalonia through Incasòl and the Barcelona City Council, will be present at Expo Real from today through Wednesday 7 October in Munich.

Read MorePREA conference: Europe has bottomed out, says Blackstone's Gray

European real estate has bottomed out, while the Brazilian market is similar to India several years ago, Blackstone’s global head of real estate told the Pension Real Estate Association (PREA) last week.

Read MoreAllianz RE finances mall in debut Spanish deal

Allianz Real Estate has financed a Spanish retail asset for Merlin Properties, its first in Spain.

The German investor said it has provided Merlin’s Retail Socimi REIT vehicle with a €133.6m ($152m) loan facility on the Marineda centre, in La Coruna.

Merlin paid €270m for the 200,000sqm asset in July last year at a 6.6% net initial yield. The deal was the largest single-asset investment in the shopping centre sector in Spain since 2008.

Read MoreIBA Capital Partners acquires Vodafone HQ in Madrid

IBA Capital Partners has acquired the headquarters of Vodafone in Spain at 115, Avenida de America in Madrid through Iberia Nora Socimi on behalf of Zambal Socimi SA (a Core+ investment vehicle).

Read MoreEconomic activity in Madrid outperformed Spain

The political leadership of Madrid is significant for Spanish and European politics. Madrid is the third largest city in Europe after London and Paris, comprises 10% of the Spanish GDP and has the third largest metro GDP in the EU.

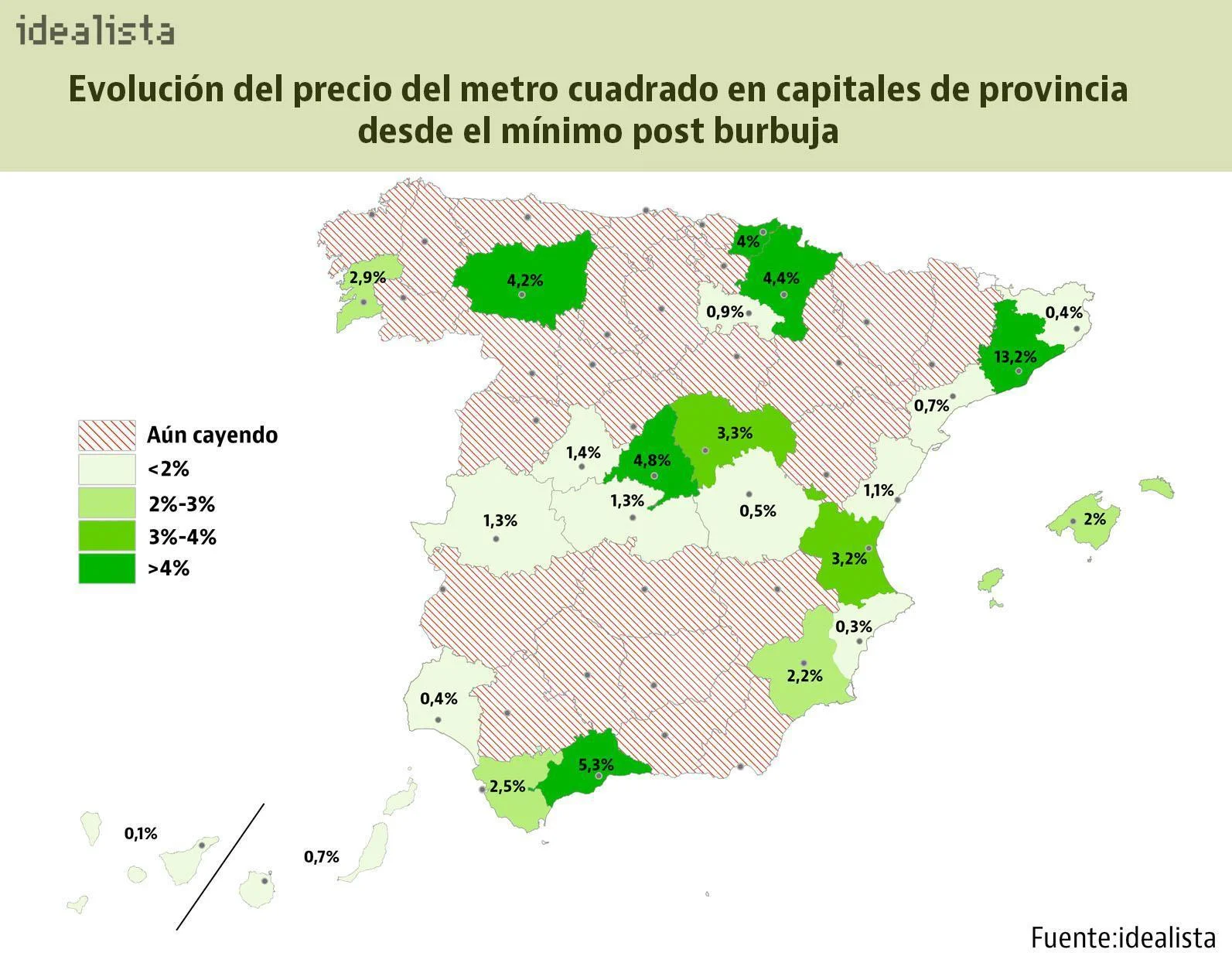

Read MorePost-bubble price evolution per sqm in Spain's major provinces

Source: Idealista

Debt Funds: At the margins

More than €4.6bn was raised for European-focused debt funds in the first half of this year, according to Preqin. “The continued strong fundraising suggests that institutional investors still believe there are plenty of opportunities,” says Preqin head of real assets products, Andrew Moylan. “But it’s certainly becoming tougher to put capital to work.”

Read MoreCMBS: European renaissance

The rise of ‘unrated’ CMBS and growing activity in markets like Italy show the European market is undergoing a renaissance.

The number of commercial real estate transactions in Europe is expected to rise exponentially by the end of the year. The appetite among investors for packaging the purchases of commercial real estate into bonds has soared and, as the market re-opens after a summer lull, the demand for commercial mortgage-backed securities (CMBS) in Europe could rise dramatically.

Read MoreSpain's Credit Rating Upgraded to BBB+ by S&P

Spain’s credit rating was raised to BBB+ by Standard & Poor’s, which cited reforms to labor regulations, improved export competitiveness and easier financial conditions for the economy.

The outlook for the rating is stable, S&P said in a statement Friday. The one-level upgrade was the first step taken on Spain’s rating by S&P since it upgraded the country to BBB in May 2014. The new rating is three levels above non-investment grade.

Read MoreOPTIMUS GLOBAL INVESTORS FEATURED IN THE OCTOBER 2015 EDITION OF IREI, INSTITUTIONAL REAL ESTATE, WITH A SPECIAL ON SPAIN’S REAL ESTATE MARKET – contact us to discuss

The composition conundrum

Back in May, global real estate services firm DTZ said that €125 billion of new capital was targeting European commercial real estate, which was putting the region on track to beat its previous annual peak investment volume of €230 billion.

Europe’s macroeconomic climate, among other factors, has continued to make real estate in the continent a very attractive proposition. The falling Euro compared to a relatively strong dollar, for example, only helps to boost the region’s appeal.

Such is the pent-up demand from certain buyers for European market share that they are, in fact, willing to pay a premium for large portfolios that can offer such share in one fell swoop. The long-held principle of buying property wholesale and selling retail is being turned on its head.

European commercial property investment with strongest first half since 2007

Europe's commercial real estate investment market has had its strongest first half in eight years, putting it on course to eclipse the annual record level attained at the tail-end of the last market boom in 2007 by December, analysis by research firm Real Capital Analytics (RCA) shows.

Read MoreBlackstone Gets $15.8 Billion for Biggest Ever Real Estate Fund

Blackstone Group LP, the world’s biggest alternative-asset manager, gathered $15.8 billion for the largest fund to invest in global real estate.

The firm collected more than 90 percent of the pool, its eighth fund for global property, from institutions in about four months, a person with knowledge of the matter said in March. The remainder was raised from individual investors, a process that takes longer to complete because of the paperwork involved, the person said.

Read MoreMadrid, Barcelona and Costa del Sol lead the Spanish recovery

A recovery is taking shape in some segments of the Spanish property market, primarily in Madrid, Barcelona, and the Costa del Sol, explains a new report from Solvia – the fourth biggest real estate servicer in Spain.

Read MoreReal estate remains attractive, but are institutions overlooking other opportunities in the private markets sphere?

Real estate remains a core asset for many institutional investors, and rightly so. The manager universe is broad and established with a transparent track record and the market continues to offer an array of opportunities that generate attractive risk-adjusted returns. However, investors should also be considering other asset classes within the private markets sphere that offer strong returns and opportunities to match investments with long-term liabilities.

Read MoreInvestors can see value once again in Spain's real estate markets

2014 was characterised by the en masse arrival in Spain of international investors and by the creation of large Spain-REITs, Sociedades Anónimas Cotizadas de Inversión en el Mercado Inmobiliario or SOCIMIs. After seven years of being a no-go area, Spain has transformed into one of the hottest markets for investors. Last year alone, more than €7 billion was invested in commercial real estate — almost three times the amount invested in 2013, when transaction activity stood at €2.5 billion.

The influx of investor interest is mainly due to Spain’s economic recovery and the attractive price levels. Spain has been one of the best performers in the euro zone, with consistent quarterly GDP growth since mid-2013. Euro zone growth has been mixed, rising by 0.8 percent in 2014 whereas Spain’s GDP grew at 1.4 percent over the same period — Spain is expected to grow by 2.8 percent in 2015 and by 2.5 percent in 2016.

The recovery is demonstrated by all the main economic indicators, such as increased consumer confidence, an improved labour market, greater disposable income and higher household consumption, as well as by improved access to financing.

Read MoreThe global hunt for yield: Investors are going further afield and exploring alternatives in a low-return environment

Five years into the global economy’s recovery, interest rates remain low by historical standards. As such, investors’ hunt for yield is intensifying. Fixed-income returns are low, and stock market returns are volatile, pushing investors into alternatives such as real estate.

As the recovery in the global economy and real estate markets transitions into a broader cyclical upswing — with activity supported by improving underlying growth prospects, a favourable policy environment, lower energy prices and stronger US consumer spending — the weight of capital targeting property continues to increase and transaction volumes continue to grow.

Read More