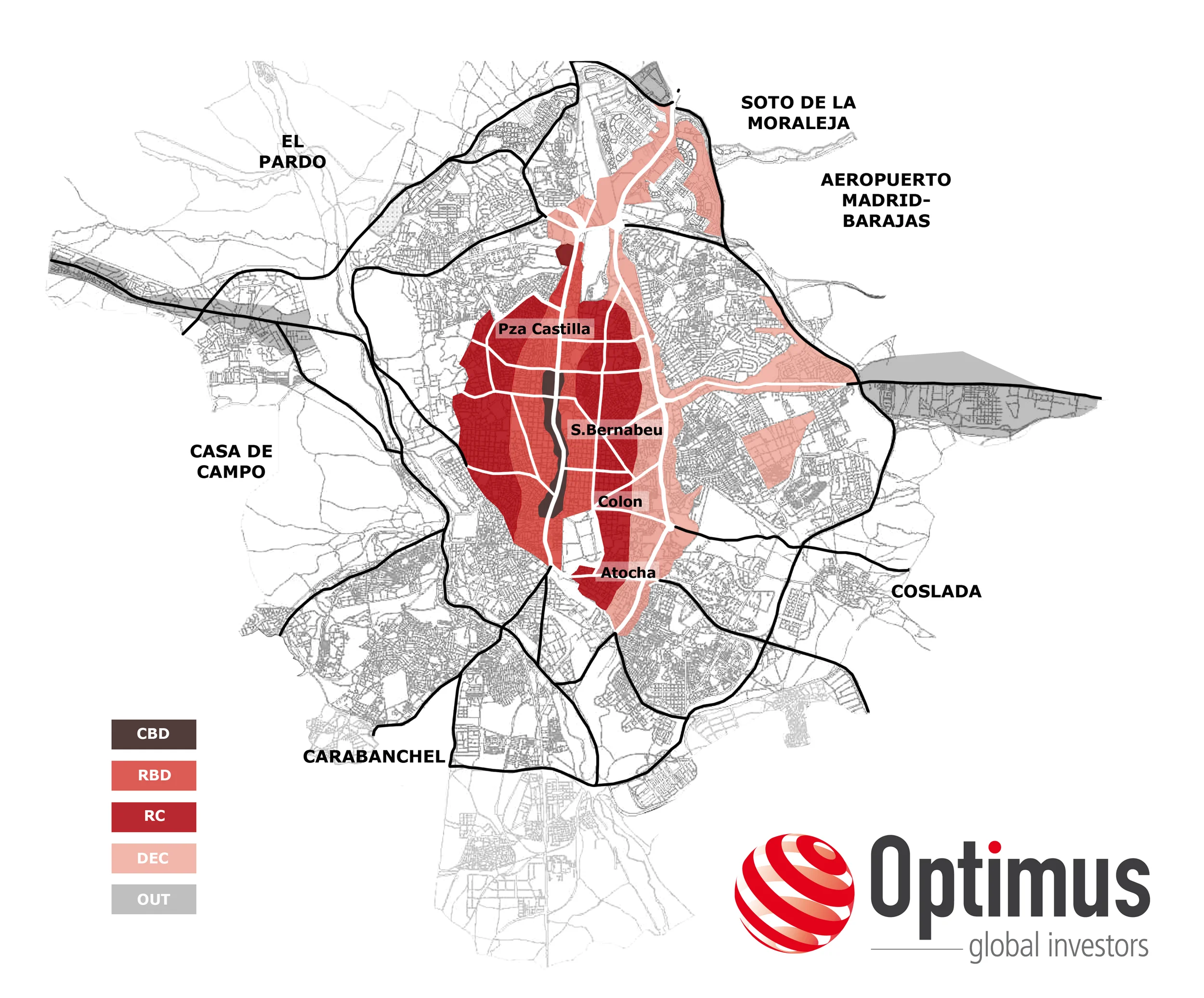

In Madrid, the area within the M-30 ring road accounted for between 40 and 50% of all office take-up in the crisis years. Given that the lion’s share of existing refurbishment projects are located within this area, it is logical to suggest that this trend will continue up until at least the start of 2017. We also expect that take-up will increase in the more consolidated business areas beside the A-1 and A-2 highways.

Office take-up in Barcelona is expected to continue to move out to areas with greater supply, such as Plaça Europa and Zona Franca, in the New Business Areas sub- market. The 22@ district is leaving behind its image of being a technological district and is becoming a prime area of the Barcelona market, of interest to all companies. It will also continue to be a highly active market, despite the lack of space in the Plaça de les Glories area.

There is a clear lack of office quality space in the best areas, both in Madrid and in Barcelona. Although the vacancy rates are relatively high in both cities (15.9% and 14% respectively), this drops to below 8% on the Paseo de la Castellana in Madrid and 4% in areas such as Plaça de les Glories or the stretch of the CBD that runs from Avinguda Diagonal between Plaça de Pius XII and Avinguda Sarrià in Barcelona, with it being extremely difficult to find large available office spaces and/or quality spaces.

Expect to see more cranes on the horizon

After many years of virtually no construction, and considering the current situation and forecasts for the sector, it is logical to assume that we will see an upturn in new-build schemes in the coming months. Since 2014, there has been a continual rise in the number of office buildings being fully refurbished in Madrid. If in 2014 this figure hardly reached 50,000 sqm, in 2015 it stood at 100,000 sqm and in 2016 it will again double last year's figure, with approximately 70% of that space currently unlet. The recovery in speculative development is still in its infancy and there are only three properties currently under construction, accounting for a total of 34,000 sqm of office space.

In contrast, in Barcelona there are very few refurbishments, although various new-build projects are expected to be delivered in 2016, amounting to a total of almost 58,000 sqm of office space, of which 38,000 sqm is available. A further 11,000 sqm of refurbished space will come on to the market. New- build projects will also start, which are expected to be delivered in 2018.

We are also seeing a growing commitment by owners and developers to provide sustainable and energy efficient properties. This is demonstrated by the fact that the vast majority of properties recently refurbished or being refurbished have obtained or are in the process of obtaining some form of LEED or BREEAM certification.

With low levels of future supply and an increase in take-up levels, it is anticipated that available supply will continue to fall, with the overall vacancy rate expected to decrease by between 1.5 and 2 points, compared to the current vacancy rates in both cities.

Rents will increase in the majority of submarkets

The return to more standard incentives offered to new tenants registered in 2015, which was seen in the majority of submarkets, was the first step prior to the next, rental uplift. As there is no danger of oversupply and there is expected to continue to be active demand, rents will continue to rise in 2016. In Madrid, rents will continue to rise in the best properties in the CBD and we will start to see the first signs of rental increases in the best inner periphery areas. In the CBD, we expect the prime rent to rise to €28.5-29 per sqm/month in Madrid and €21-21.50 per sqm/month in Barcelona by the end of 2016, with some very specific lettings being closed above these figures for the highest quality properties. In Barcelona, we would highlight the expected growth in the New Business Areas (circa 12%) the highest in all of the sub-markets, which would put the rent at €19.00 per sqm/month. The remaining sub-markets are also expected to see growth, but these will see more subdued growth.

Office Map Madrid