Europe’s commercial real estate (CRE) loan portfolio market will bounce back in 2017 with sales expected to rise by up to 21% to as much as €60bn.

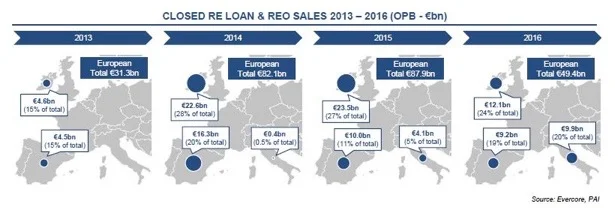

Transaction volumes in Europe’s NPL market fell 44% last year to c.€49.4bn, on a nominally-valued basis, comprised of 89 CRE and residential loan pools and sales of real estate-owned entities (REO), according to figures compiled by Evercore’s real estate portfolio solutions (REPS) team. While last year’s annual transaction levels were substantially down on 2015’s €87.9bn high watermark year, with the NPL market not immune to the broader seismic political and macro uncertainty, there was a surge in activity towards the end of the 2016 with c.€13.8bn of sales completing in December, as both vendors and investors looked to hit annual targets.

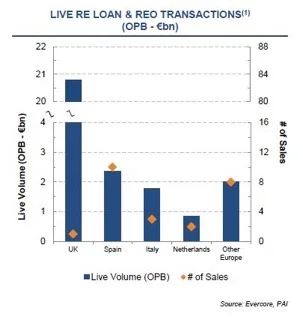

A combined live and planned pipeline across Europe of €46.6bn – comprised of c.€27.8bn in 28 live transactions and €18.8bn in planned NPL sales, predominantly driven by anticipated sales from Spain and Italy. This tally has led to Evercore’s forecast of total European NPL sales in 2017 of between €50-60bn, a range highly-dependent on the success of the single largest visible NPL transaction, UK Asset Resolution’s (UKAR) £16bn Bradford & Bingley UK residential mortgage pool. According to the Sunday Times, Blackstone, Cerberus and TSB, the challenger bank spun off from Lloyds Bank, are among the bidders.

Spain and Italy account for 36% and 34%, respectively of planned NPL sales, with several Spanish banks preparing loan and REO sales for 2017, as well as SAREB. Indeed, Evercore predicts Spain will provide the highest volume of NPL sales by jurisdiction in 2017. “With a high level of REOs to dispose of, Spanish vendors are likely to continue their activity in 2017.” In Italy, the fate of €8.5bn in secured and unsecured loans from the four failed Italian banks still to be decided. “It is anticipated that with the [failed Italian banks] acquisition of these banks nearing completion, an NPL sale will be launched at some point in the future. Going forward, Italy’s share of planned and live sales is expected to be higher than in previous years, with banks urgently needing to raise capital.”

NPL buyers are focusing on acquiring loan servicers to secure access to banks’ defaulted debt, akin to the trend seen in Spain. In addition, Ireland is not done quite yet, suggesting that final NANA sales could emerge as well as potential trades out of Allied Irish Bank’s (AIB) c.€9bn remaining non-core real estate exposure. Germany is unlikely to yield much NPL transactional activity beyond potential activity from FMS Wertmanagement and HSH Nordbank’s live £2.7bn Project Leo NPL, which includes Cisco Systems’ HQ near Heathrow Airport; law firm CMS’ head office at Cannon Place in the City and hedge fund Man Group’s City offices at Riverbank House.

Approximately 71% of the total volume closed relates to CRE loans, with a further 20% relating to residential mortgages and the remaining 9% to REOs. However, the level of REOs coming to the market is likely to increase in 2017 driven by changes to Spanish regulations. There were nine “mega-deals” in 2016 above €1bn in nominal value, including five with a combined face value of €20.7bn, around 42% of the total for 2016. They were:

- Unicredit’s Project Fino – c.€5.9bn: UniCredit sold a major portion of its NPL portfolio in the form of the €17.7bn Project Fino, with an estimated one third secured by real estate. The portfolio was split into two sub-portfolios of €13.5bn and €4.2bn, securitised and then approximately half the notes sold to Fortress and PIMCO respectively. UniCredit is reportedly planning to hold the remainder of the notes

- Project Swan – c.€5.2bn: Propertize completed the largest loan portfolio transaction ever recorded in the Netherlands, selling the entirety of its remaining former SNS Reaal assets to Lone Star and JP Morgan;

- Projects Emerald & Ruby – c.€3.9bn: As part of a busy year for the Irish AMA, NAMA chose Oaktree Capital as the successful bidder for its Projects Emerald & Ruby;

- Project Ravenhill - c.€3.0bn: Accounting for 58% of the UK total, Permanent TSB completed its deleveraging programme with the sale of its remaining Capital Homes mortgages to Cerberus

Cerberus was the largest NPL investor in Europe in 2016, topping the league table for the third consecutive year, acquiring €9.4bn of real estate loans across eight transactions, including: RBS's €2.4bn Project Oyster, Permanent TSB's €3.0bn Project Ravenhill, and NAMA's €2.7bn Project Gem. Cerberus’ acquisitions reflected almost one-fifth of all European sales in 2016. Oaktree Capital climbed to take the second spot, completing its largest European loan sales transaction to date in NAMA's Projects Emerald and Ruby, before closing the year with its purchase of Banco Sabadell’s Project Normandy. Lone Star and JP Morgan took third place, following their joint acquisition of Propertize's Project Swan. Fortress and Apollo completed the top five.

Source: Evercore