Whilst improving global economic conditions during the first quarter of the year are supporting sentiment in most parts of the world, EU markets continue to lead the way. With respect to occupier demand growth, Madrid, Budapest, Dublin, Munich, Berlin and Lisbon, posted particularly strong results according to the latest RICS Commercial Property Monitor.

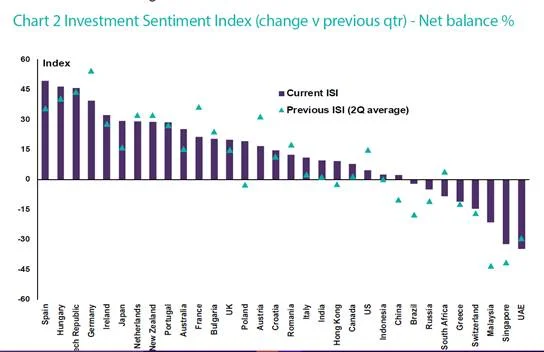

In terms of global investment trends in commercial property, the latest results point to Spain seeing the sharpest quarterly improvement in market conditions. Indeed, respondents reported a robust rise in investment enquiries during Q1 and are now more confident of seeing further near term capital value growth than at any other point since 2008 (net balance of +62%). When broken down, projections in Madrid are slightly stronger than the national average.

Elsewhere, Hungary, the Czech Republic, Germany and Ireland all retained strong Investment Sentiment Index readings. In each case, growth in demand is outstripping that of supply (in net balance terms), producing solid expectations for capital value growth. Notwithstanding this, across Prague, Hamburg, Frankfurt, Munich and Berlin, perceptions are rising that market conditions may be close to peaking.

Looking at market sentiment Post-Brexit, this quarter, the highest proportion of respondents across Dublin and Amsterdam reported seeing enquiries for space from businesses looking to relocate some part of their business away from the UK (relative to all other areas).

Outside of Europe, Sydney and Auckland also show strong positive momentum in tenant demand in 2017. Also news flow is gradually beginning to improve in Russia and Brazil, following a difficult three years in which both economies have grappled with deep recessions, In Russia, occupier demand picked-up for the first time since 2013, pushing rental projections modestly higher as a result. 40% of respondents are now of the opinion the market has started to recover in Russia.

On the other hand, feedback from respondents still remains somewhat cautious in parts of Asia and the Middle East and in the US market, investment enquiries were reportedly flat over the period, marking the first quarter since 2010 in which demand has failed to rise.

Source: Europe Real Estate