Lockdowns and social distancing have impacted many tenant businesses, resulting in an unprecedented number of requests for rental relief, stressing real estate rental-income streams.

For equity investors, income returns have weakened, despite softening asset values. Recent income returns may understate the full potential impact as accrual of deferred rents may mask further shortfalls.

Lower rental incomes may also stress debt covenants and increase servicing pressures on some loans. In loans that default and are foreclosed upon, falling asset values may also increase potential loss severity.

Rental income is the lifeblood of real estate. Without it, property funds are not able to pay distributions to shareholders and borrowers cannot service their debt. The contractual nature of property rental income, a key feature of the asset class, underpins asset values and by extension property and fund returns. The COVID-19 pandemic has put occupiers under financial pressure, which has in turn stressed property funds’ rental income. We analyzed fund- and asset-level data for 107 property funds in the U.K., Europe, Australia and North America to assess the impact of slowing net-income growth on distribution yields, performance and debt-service ratios during the COVID-19 pandemic. Our analysis suggests that real estate investors may want to consider new ways of analyzing income risk and benchmarking the income performance of their portfolios.

Real Estate Income Was Impacted by the Pandemic

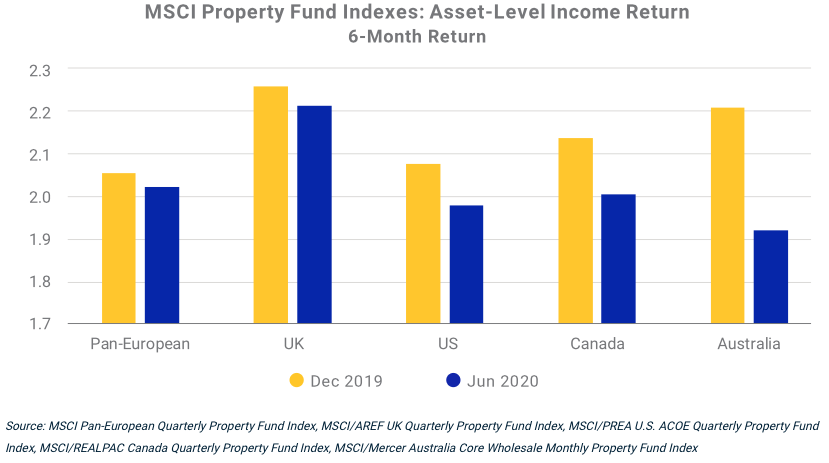

The COVID-19 pandemic has impacted the business operations of many real estate occupiers, stressing landlords’ rental-income streams. To illustrate the extent of the impact, we compared the asset-level income return of five regional MSCI property-fund indexes for the six-month periods ended December 2019 and June 2020. All five indexes showed lower income return in June 2020 compared to December 2019.

Income Returns Are Lower than They Were Pre-pandemic

Using the MSCI Global Quarterly Property Fund Index, we assessed the impact of the pandemic on asset-level net operating income (NOI) across the main property sectors. Effects were not uniformly distributed, with retail and hotel assets particularly impacted by lockdowns and social distancing, while the industrial sector continued its outperformance.

On a same-store basis, the biannual NOI of retail assets declined by 21.4%, while hotel assets saw a 39.7% drop. Industrial property’s net income grew 1.4%, which was only marginally down on the prior six-month period. The office sector saw its NOI growth remain flat, notwithstanding the uncertain demand outlook for corporate office space, while residential property also recorded flat net income growth for the six months to June.

Retail and Hotel Rental Incomes Were the Hardest Hit During COVID-19

Bearing in mind that asset-level income returns are calculated on an accrual basis, could actual fund distribution yields tell us something that property income doesn’t? As their cash flows were disrupted, many funds adjusted the shareholder distributions by slowing, suspending or deferring payouts. As a result, the spread between asset-level NOI yields and funds’ distribution yields has increased, suggesting that property-level rent collections may be lagging accruals.

Globally, we saw a 20-basis-point (bp) widening in the spread between the asset NOI yield and fund distribution yield, while higher impacts were observed in the U.K. (+20 bps) and Australia (+30 bps).

Fund Distributions Fell More than Incomes, Suggesting Collections May Be Lagging Accruals

Income Stress Could Affect Real Estate Debt

In addition to the impact on fund distributions, the income reductions caused by the pandemic could have implications for real estate debt markets.

Debt in commercial real estate became a major pain point for some investors during the last major downturn, the 2008 global financial crisis (GFC). With investors more aware of the risks associated with debt, there has been a general deleveraging trend over the course of the current cycle. For example, debt as a percentage of gross asset value (GAV) in MSCI’s core, open-ended real estate indexes increased as asset values fell during the GFC, but have generally moderated since then to levels close to or lower than where they were before the financial crisis.

Debt Levels in Core Funds Have Remained Relatively Stable in Recent Years

While investors have generally remained more cautious about debt, the unique and unforeseen nature of the current crisis may pose challenges. In particular, the reduction in real estate income caused by the pandemic could have ramifications, with lower incomes potentially making it harder for some borrowers to service their loans.

To illustrate why this may be the case, we use data from the MSCI/PREA U.S. ACOE Quarterly Property Fund Index to calculate simple debt-service coverage ratios (DSCRs). The ratios may not exactly match the covenants written into loans — they have been calculated by dividing NOI from the assets by the interest and financing costs on debt — but they do help to illustrate the potential impact of the crisis on loan servicing.

Focusing on the aggregate index first, the DSCR is higher than it was at the end of 2007, suggesting that, at least in U.S. core funds, there is more buffer than there was pre-GFC. Comparing the fourth quarter of 2019 to the second quarter of 2020 to see what impact the pandemic has had, we see that the ratio has declined slightly since the end of last year, from 4.8 to 4.7, with the falls in income being partially offset by lower borrowing costs.

While there has been only a small movement at the aggregate level, when we break the ratios down by property type, we see how the larger falls in income for sectors like retail have had a more pronounced impact on the ratios. At the end of 2019, the ratio of NOI to borrowing costs stood at 5.0 for retail but fell to 3.3 six months later. While retail assets in the U.S. ACOE index were still generating over three times more NOI than borrowing costs, the observed reduction in buffer may be replicated outside of core markets too. For assets with higher debt or that had lower buffer pre-pandemic, the falls in income could therefore cause more serious servicing risks.

Income Falls Could Be Increasing Servicing Pressures, Particularly for Certain Sectors

In addition to the risks that reduced rental income could pose to income covenants and loan servicing, debt investors may face an additional risk in falling asset values. In the first six months of 2020, aggregate asset values in the MSCI Global Quarterly Property Index fell by 3.6% with sectors like retail and hotel seeing even larger declines (-8.7% and -6.9%, respectively). As asset values decrease, this can increase loan-to-value (LTV) ratios, resulting in greater potential loss severity for loans that default and are foreclosed on. Debt investors may therefore find asset-value-growth indexes useful for tracking the LTV ratios in their portfolio.

The Importance of Risk and Performance Monitoring

While some of the income disruption currently being experienced may be temporary and reversible once the pandemic is over, considerable uncertainty remains for real estate investors, in both debt and equity real estate. With the virus continuing to impact global economies and the path to recovery still unknown, rent stress and income disruption may continue for some time. Investors may therefore want to consider new ways of analyzing income risk and benchmarking the income performance of their portfolios.

Source: MSCI